Is Yellen Worried That She Is Causing Asset Bubbles? Here Is What She Said

Yellen Responds To Trump

No, The Fed Doesn't Have A Plan. Yes, The Fed Really Is Monetizing Government Debt

Janet Yellen Tries To Explain Why Donald Trump Is Wrong - Fed Press Conference Live Feed

Fed Now Sees Only Three Rate Hikes Thru End Of 2017; Cuts Long-Run US GDP Potential

Fed Inaction Sparks Buying In Bonds, Stocks, Gold, Oil As VIX Tanks

Fed Chickens Out: 3 Presidents Dissent As Fed "Decides To Wait For Further Evidence" Of Strengthening Before Hiking

The honest answer is that the US Dollar is just about worthless...causing inflation...The Dollar has lost 97% of it's purchasing power since the Fed was created...END the FED...

Mylan CEO Explains To Congress Why EpiPen Prices Rose 550% in 9 Years - Live Feed

Russia Deploys Flagship Aircraft Carrier To Syria Coast

$195 Billion Asset Manager: "The Time Has Come To Leave The Dance Floor"

Suddenly Wall Street Is Sweating: "A September Rate Hike Would Lead To A Big Shock"

The Three Stages Of Empire

Canadian Mint Employee Allegedly Smuggled $140,000 Of Gold Inside His Rectum

FBI Release Photos Of 2 More "Unknown Individuals" Related To NY Bombing

The Economy, The Stock Market, & The Fed

Crowdfunded House Flipper Raises $1 Million In 12 Hours... And It Only Costs Him 14%

Is Trump Wrong On Trade?

SEC Charges Hedge Fund Icon Leon Cooperman With Insider Trading

Apple In Talks To Buy Supercar Maker McLaren

Crude Extends Gains After Bigger Than Expected Inventory Draw (Despite Production Rise)

How does it make you feel that Millions are on welfare and food stamps and homeless while the lowlife scum politicians get us deeper and deeper in debt...giving money to their friends...

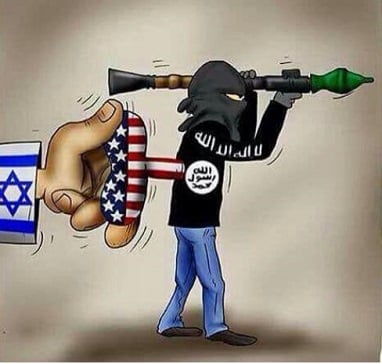

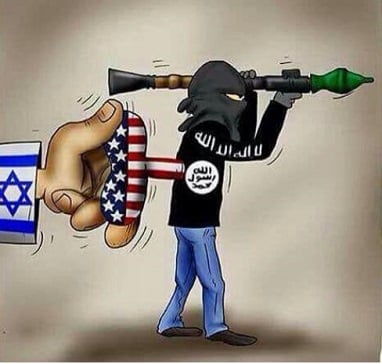

Last week’s announcement of a record-breaking US aid package for Israel

underscores how dangerously foolish and out-of-touch is our

interventionist foreign policy. Over the next ten years, the US taxpayer

will be forced to give Israel some $38 billion dollars in military aid.

It is money we cannot afford going to a country that needs no

assistance to maintain its status as the most powerful military in the

Middle East.

Last week’s announcement of a record-breaking US aid package for Israel

underscores how dangerously foolish and out-of-touch is our

interventionist foreign policy. Over the next ten years, the US taxpayer

will be forced to give Israel some $38 billion dollars in military aid.

It is money we cannot afford going to a country that needs no

assistance to maintain its status as the most powerful military in the

Middle East.All US foreign aid is immoral and counterproductive. As I have often said, it is money taken from poor people in the US and sent to rich people overseas. That is because US assistance money goes to foreign governments to hand out as they see fit. Often that assistance is stolen outright or it goes to the politically connected in the recipient country.

Read More

from X22Report Spotlight:

by Prof Michel Chossudovsky, Global Research:

These testimonies by Syrian soldiers who are fighting the Islamic State rebels (ISIS-Daesh) confirm what we already know.

These testimonies by Syrian soldiers who are fighting the Islamic State rebels (ISIS-Daesh) confirm what we already know.

The United States of America is not fighting the terrorists in Syria.

The Obama administration, with the support of its allies including Turkey and Saudi Arabia, is supporting the Islamic State (ISIS Daesh)

Obama’s counterterrorism campaign in Syria and Iraq is bogus.

Read carefully:

The testimonies confirm the unspoken truth:

Read More

These testimonies by Syrian soldiers who are fighting the Islamic State rebels (ISIS-Daesh) confirm what we already know.

These testimonies by Syrian soldiers who are fighting the Islamic State rebels (ISIS-Daesh) confirm what we already know.The United States of America is not fighting the terrorists in Syria.

The Obama administration, with the support of its allies including Turkey and Saudi Arabia, is supporting the Islamic State (ISIS Daesh)

Obama’s counterterrorism campaign in Syria and Iraq is bogus.

Read carefully:

The testimonies confirm the unspoken truth:

Read More

by Dan Riehl, Breitbart:

Long-time Democratic pollster Pat Caddell joined Breitbart News Daily

SiriusXM host Alex Marlow on Tuesday to discuss recent polling, as well

as news that former President George H.W. Bush may be voting for

Democrat Hillary Clinton. “This is a protection racket here, and they

have never been under greater threat,” said Caddell, referencing the

candidacy of GOP nominee Donald Trump.

Long-time Democratic pollster Pat Caddell joined Breitbart News Daily

SiriusXM host Alex Marlow on Tuesday to discuss recent polling, as well

as news that former President George H.W. Bush may be voting for

Democrat Hillary Clinton. “This is a protection racket here, and they

have never been under greater threat,” said Caddell, referencing the

candidacy of GOP nominee Donald Trump.

“It’s not surprising in a way,” he continued. “We misunderstand that this Trump thing is not so much an ideological contest, even a partisan contest. It’s really an insurgency against the political class by the people. That’s why both Bernie Sanders and Trump did so well” in their respective primaries.

Read More

Long-time Democratic pollster Pat Caddell joined Breitbart News Daily

SiriusXM host Alex Marlow on Tuesday to discuss recent polling, as well

as news that former President George H.W. Bush may be voting for

Democrat Hillary Clinton. “This is a protection racket here, and they

have never been under greater threat,” said Caddell, referencing the

candidacy of GOP nominee Donald Trump.

Long-time Democratic pollster Pat Caddell joined Breitbart News Daily

SiriusXM host Alex Marlow on Tuesday to discuss recent polling, as well

as news that former President George H.W. Bush may be voting for

Democrat Hillary Clinton. “This is a protection racket here, and they

have never been under greater threat,” said Caddell, referencing the

candidacy of GOP nominee Donald Trump.“It’s not surprising in a way,” he continued. “We misunderstand that this Trump thing is not so much an ideological contest, even a partisan contest. It’s really an insurgency against the political class by the people. That’s why both Bernie Sanders and Trump did so well” in their respective primaries.

Read More

from InfoWars:

Breaking news: Major climate science error exposed!

Breaking news: Major climate science error exposed!

At the recent high-level climate change conference in London, a fundamental error in climate science was revealed for the first time.

The much-vaunted “climate consensus” turns out to have been wrong all along.

At the London conference, 80 Professors, 60 Doctors of Science and 40 other experts, including Piers Corbyn, brother of Britain’s opposition leader, who has a first-class degree in Astrophysics, were shocked to learn that the error, first introduced a generation ago when climate scientists borrowed feedback math from electronic network analysis without really understanding it, is the reason for their exaggerated predictions of how much global warming Man may cause.

Read More

Breaking news: Major climate science error exposed!

Breaking news: Major climate science error exposed!At the recent high-level climate change conference in London, a fundamental error in climate science was revealed for the first time.

The much-vaunted “climate consensus” turns out to have been wrong all along.

At the London conference, 80 Professors, 60 Doctors of Science and 40 other experts, including Piers Corbyn, brother of Britain’s opposition leader, who has a first-class degree in Astrophysics, were shocked to learn that the error, first introduced a generation ago when climate scientists borrowed feedback math from electronic network analysis without really understanding it, is the reason for their exaggerated predictions of how much global warming Man may cause.

Read More

by Clint Siegner, Money Metals:

Harvard professor and economist Ken Rogoff is once again leading the

chorus of high-level academics and officials who declare cash is only

for criminals. He made his case in a recent Wall Street Journal

editorial called the “Sinister Side of Cash.” The solution, he declares,

is to simply get rid of anything but the smallest bank notes.

Harvard professor and economist Ken Rogoff is once again leading the

chorus of high-level academics and officials who declare cash is only

for criminals. He made his case in a recent Wall Street Journal

editorial called the “Sinister Side of Cash.” The solution, he declares,

is to simply get rid of anything but the smallest bank notes.

In his vision, drug dealers, human traffickers, and tax cheats are everywhere, but they are reliant on cash. Our benevolent central planners can largely incapacitate them by ridding society of anything larger than a $10 bill.

Read More

In his vision, drug dealers, human traffickers, and tax cheats are everywhere, but they are reliant on cash. Our benevolent central planners can largely incapacitate them by ridding society of anything larger than a $10 bill.

Read More

by Doug Casey, Casey Research:

“It’s a very dangerous time” to be an investor.

“It’s a very dangerous time” to be an investor.

You might think is a quote from Casey Research founder Doug Casey. But Paul Singer actually said this last week at the Delivering Alpha conference in New York City.

Delivering Alpha is one of the most anticipated investing conferences of the year. Investors from around the world attend it to hear from the “who’s who” in the investing world.

This year, many of the world’s top investors agreed on one thing: the markets are very dangerous.

Read More

“It’s a very dangerous time” to be an investor.

“It’s a very dangerous time” to be an investor.You might think is a quote from Casey Research founder Doug Casey. But Paul Singer actually said this last week at the Delivering Alpha conference in New York City.

Delivering Alpha is one of the most anticipated investing conferences of the year. Investors from around the world attend it to hear from the “who’s who” in the investing world.

This year, many of the world’s top investors agreed on one thing: the markets are very dangerous.

Read More

by Andy Hoffman, Miles Franklin:

Am I allowed to start with Deutsche Bank? Or do I have to defer to the

Bank of Japan’s Keystone Kops; who once again laid a giant goose egg?

Who, beyond a shadow of a doubt, proved they have not a clue what they

are doing – in dramatically accelerating the pace at which the “Land of

the Setting Sun” plunges to “second world” status, en route to becoming

the first “Western Power” to experience 21st Century hyperinflation.

Am I allowed to start with Deutsche Bank? Or do I have to defer to the

Bank of Japan’s Keystone Kops; who once again laid a giant goose egg?

Who, beyond a shadow of a doubt, proved they have not a clue what they

are doing – in dramatically accelerating the pace at which the “Land of

the Setting Sun” plunges to “second world” status, en route to becoming

the first “Western Power” to experience 21st Century hyperinflation.

Hmmm, what to do? As sadly, I could easily write entire articles on countless other topics as well – such as the Bank of International Settlements issuing a dire warning about the massively over leveraged Chinese banking sector; Donald Trump’s surging popularity; Wells Fargo’s “crime of a lifetime”; the exploding worldwide pension crisis; OPEC’s Secretary General all but confirming “no deal” at next week’s “all-important” crude oil producers meeting; and the U.S. national debt – and budget deficit – expanding at the fastest rate since the 2008-09 financial crisis. And the answer is, I’m starting with Deutsche Bank – as unquestionably, it poses the greatest near-term risk to global political, economic, social, and monetary stability.

Read More

Am I allowed to start with Deutsche Bank? Or do I have to defer to the

Bank of Japan’s Keystone Kops; who once again laid a giant goose egg?

Who, beyond a shadow of a doubt, proved they have not a clue what they

are doing – in dramatically accelerating the pace at which the “Land of

the Setting Sun” plunges to “second world” status, en route to becoming

the first “Western Power” to experience 21st Century hyperinflation.

Am I allowed to start with Deutsche Bank? Or do I have to defer to the

Bank of Japan’s Keystone Kops; who once again laid a giant goose egg?

Who, beyond a shadow of a doubt, proved they have not a clue what they

are doing – in dramatically accelerating the pace at which the “Land of

the Setting Sun” plunges to “second world” status, en route to becoming

the first “Western Power” to experience 21st Century hyperinflation.Hmmm, what to do? As sadly, I could easily write entire articles on countless other topics as well – such as the Bank of International Settlements issuing a dire warning about the massively over leveraged Chinese banking sector; Donald Trump’s surging popularity; Wells Fargo’s “crime of a lifetime”; the exploding worldwide pension crisis; OPEC’s Secretary General all but confirming “no deal” at next week’s “all-important” crude oil producers meeting; and the U.S. national debt – and budget deficit – expanding at the fastest rate since the 2008-09 financial crisis. And the answer is, I’m starting with Deutsche Bank – as unquestionably, it poses the greatest near-term risk to global political, economic, social, and monetary stability.

Read More

by Dave Kranzler, Investment Research Dynamics:

No way to know for sure when the Bundesbank, Fed and ECB lose control

of Deutsche Bank’s balance sheet. But its stock price just hit an

all-time low since its NYSE-listing in October 2001.

No way to know for sure when the Bundesbank, Fed and ECB lose control

of Deutsche Bank’s balance sheet. But its stock price just hit an

all-time low since its NYSE-listing in October 2001.

Anyone who owns the Deutsche Bank “Tier 1” bonds should sell them now. They are currently yielding about 8%, which puts on the same “tier” as U.S. triple-C (CCC/Caa) rated credits.

Read More

No way to know for sure when the Bundesbank, Fed and ECB lose control

of Deutsche Bank’s balance sheet. But its stock price just hit an

all-time low since its NYSE-listing in October 2001.

No way to know for sure when the Bundesbank, Fed and ECB lose control

of Deutsche Bank’s balance sheet. But its stock price just hit an

all-time low since its NYSE-listing in October 2001.Anyone who owns the Deutsche Bank “Tier 1” bonds should sell them now. They are currently yielding about 8%, which puts on the same “tier” as U.S. triple-C (CCC/Caa) rated credits.

Read More

Stocks Explode Higher After Fed Cuts US Growth Potential To Lowest On Record

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment